Issuance of up to $90 million in bond financing. In current market conditions, the County expects to issue $19.15 million for new capital projects and approximately $45.64 to refund existing lease revenue bonds. The refunding of eligible bonds at current market rates will save the County approximately $3.77 million through 2028.

The County has two new projects to finance, approximately $6.5 million in solar panels and approximately $14 million to expand the Behavioral Health and Medical Clinic at the West County Clinic. In addition, a portion of the Authority’s existing Lease Revenue Bonds can be refunded in the current market for debt service savings.

In the current market, the Authority could issue approximately $19,150,000 of fixed rate Series 2015A Bonds (the “2015A Bonds”) to finance the acquisition and installation of solar panels and to fund the construction, acquisition, installation and equipping of the Behavioral Health and Medical Clinic. The Authority could issue approximately $45,640,000 of fixed rate Series 2015B Bonds (the “2015B Bonds”) to refund a portion of the Authority’s outstanding Lease Revenue Bonds issued under the 1999 Trust Agreement for debt service savings.

- 2015A Bonds:

- Solar Panels Project- The Authority would finance approximately $6,500,000 in project funds for the solar panels. The bonds would have level debt service and amortize over 10 years, with principal paid from 2016 through 2025.

- Behavioral Health and Medical Clinic Expansion- The Authority would finance approximately $14,000,000 in project funds for the medical clinic expansion. These bonds would have a 20 year final maturity with level debt service and principal paid from 2018 through 2035. Bond counsel has advised that no principal should amortize until expected completion of the project.

The estimated debt service based on current market rates for the 2015A Bonds is shown below:

- 2015B Bonds:

- The 2015B Bonds would be structured with uniform savings by refunded series, and based on current market conditions would include all or a portion of the following outstanding Lease Revenue Bonds:

| Issue |

Maturities to be Refunded |

Call Date |

Refunded Principal

(subject to change) |

| Series 1999A |

2016-2028 |

Within 30 days |

$11,240,000 |

| Series 2002A |

2016 |

Within 30 days |

$575,000 |

| Series 2002B |

2016-2019 |

Within 30 days |

$5,350,000 |

| Series 2003A |

2016-2017 |

Within 30 days |

$1,565,000 |

| Series 2007A |

2018-2028 |

6/1/2017 |

$41,150,000 |

Refunding savings are dependent on market rates and the savings available from a refunding of the 2007A Bonds are particularly rate sensitive, given that the call date is two years in the future. Based on current market rates, $29.14 million of the 2007A Bonds would be refunded representing only the 2020 through 2026 maturities of the 2007A Bonds. Debt service and annual debt service savings for the 2015B Bonds is shown below.

A summary of the proposed issuance is provided in the table below.

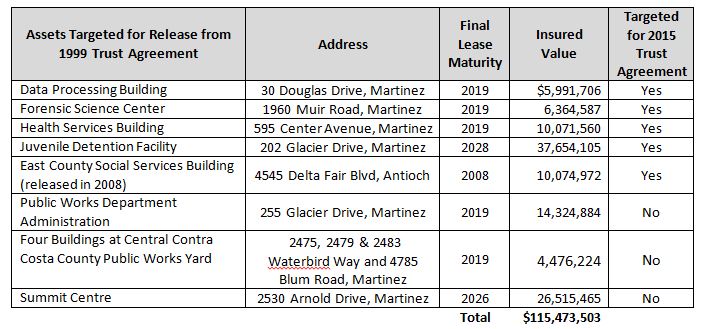

1999 Trust Agreement: All of the potential refunded bonds were issued pursuant to the 1999 Trust Agreement. Under that Trust Agreement, the County is able to purchase out and release specific leased assets by prepaying base rental payments associated with those assets. Any amendment of the lease is subject to consent of the bond insurer, National Public Finance Guarantee (“NPFG”). NPFG has consented to the amendment and the County will be able to release the assets listed in the table below from the 1999 Trust Agreement, assuming all of the Series 1999A, 2002A, 2002B and 2003A bonds are refunded, as currently planned.

Assuming the above assets are released, they will then be available to secure the 2015A and 2015B Bonds. The 2015A and 2015B Bonds would be issued under a new 2015 Trust Agreement. As with the Authority’s existing Lease Revenue Bonds, the total value of the leased facilities must equal or exceed the par amount of the bonds and the fair market rental value of the leased facilities must equal or exceed the annual debt service payments on the bonds. The 2015A and 2015B Bonds are not expected to have level overall debt service because the two new money projects have different amortization periods and the refunded bonds do not have level debt service. As such, the intention would be to secure the 2015A and 2015B Bonds with several assets, with various lease maturity dates based on the shape of the 2015A and 2015B debt service. Under current market conditions, it is expected that the Authority could issue the new money and refunding bonds using solely the assets released from the 1999 Trust Agreement. In addition, the Authority plans to release the Public Works Department Administration building, the Four Buildings at Central Contra Costa County Public Works Yard and the Summit Centre entirely. The assets that are targeted for inclusion in the 2015 Trust Indenture are indicated in the far right column of the table above.

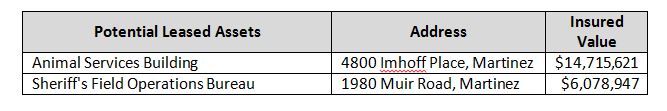

However, given volatile market conditions, the County would need to be prepared to secure additional assets in the case that the size of the refunding increases and the five buildings targeted for inclusion in the 2015 Trust Agreement are not adequate to secure the 2015 Bonds. In this case, the proposed assets to add to the financing are listed below.

All of the above results are subject to market conditions at the time of financing. It is also important to note that the results above assume that the 2015A and 2015B Bonds are issued with a surety bond to fund a reserve fund for the bonds. Piper Jaffray, the proposed underwriter for the bonds, has been in discussions with bond insurers to secure a surety bond for the financing.

It is recommended that the Board approve the proposed financing and that the documentation and potential leased assets preserve the flexibility to respond to the current market’s volatile conditions.

The Authority will be unable to issue the bonds, delaying construction and reimbursement of capital projects. In addition, the County would be unable to realize savings from refunding of existing debt.

CLOSED the public hearing; and ADOPTED recommendations as presented.