In 2004, due to growing concern over the potential magnitude of government employer obligations for post-employment benefits, the Governmental Accounting Standards Board enacted Statement 45 (GASB 45). The main reason for the Statement was to establish uniform accrual accounting and reporting of these

governmental liabilities much like under the Financial Accounting Standards Board (FASB) rules that already applied to the private sector for OPEBs (and GASB 25 and 27 statements that already applied to governmental pension liabilities). Accrual accounting was needed to report the cost of providing government services over the working lifetime of employees providing the services rather than just the "pay-as-you-go" (paygo) cost that was not realized until after those employees retired.

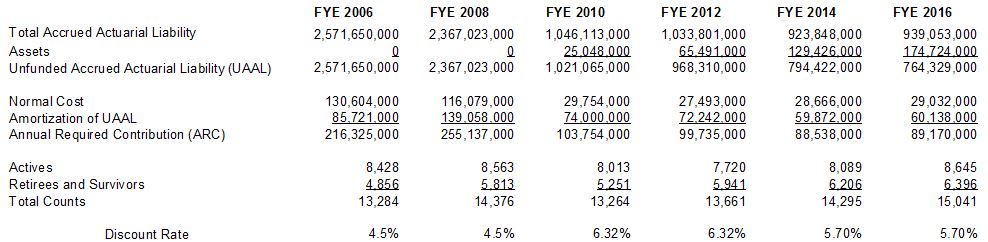

Pursuant to GASB 45 requirements, Contra Costa County ordered its initial actuarial report in 2006. The 2006 report valued the County’s unfunded liability for retiree medical costs at $2.6 billion based upon a cash discount rate. This outstanding liability, if fully amortized over the following 30 years, would have necessitated an Annual Required Contribution (ARC) of $216 million. At that point in time, $216 million would have been six times the amount that the County was paying toward retiree health care costs on a paygo basis.

In June, 2007, the County established a funding target of 100% of the potential liability for the retiree population. At that time, retirees accounted for approximately 40% of the liability population. That figure is now 44% and is expected to continue to grow. Partial pre-funding began in 2008 with an annual County allocation of $20 million. Although the County has made great strides towards reducing and funding the liability, the liability remains underfunded at 39.5%. Pursuant to County Ordinance No. 2014-04, the annual resources of $20 million will be increased by $47 million to $67 million in FY 2022/23 when the County retires its remaining Pension Obligation Bond.

As is described in the previous reports and in the table below, the County has taken significant actions to address and to reduce its OPEB liability since the initial report of 2006. Interim valuation results have been presented to the Board of Supervisors, pursuant to California Government Code 7507, since the 2008 report. For comparison purposes, the table below compares bi-annual GASB 45 valuation results at fiscal year-end (FYE).

In June 2015, the Governmental Accounting Standards Board (GASB) released new accounting standards for public sector postretirement benefit programs and the employers that sponsor them.

GASB Statements 74 and 75 overhauled the standards for accounting and financial reporting for postemployment benefits other than pensions (OPEB). They replaced the current statements, GASB 43 and 45 and are intended to improve the decision-usefulness of information in employer and governmental nonemployer contributing entity financial reports and enhance its value for assess accountability and interperiod equity by requiring recognition of the entire OPEB liability in the county’s financial statements and a more comprehensive measure of OPEB expense. The new GASB statements require a liability for OPEB obligations, known as the net OPEB liability, to be recognized on the balance sheet of the plan and the participating employers. In addition, an OPEB expense is recognized in the income statement of the participating employers.

In the last year the OPEB liability decreased significantly. The biggest reasons are:

-Health Cost trends are lower – in part due to the permanent repeal of the Excise (Cadillac) tax in December 2019, and in part due to the elimination of a Health Insurer fee charged by the Federal government.

-New demographic assumptions from the CCCERA pension valuation (i.e. retirement rates, mortality rates) have changed resulting in lower liability.

-The assumed percentage of retiring employees who elect health coverage moved downward from 90% to 85%.

-Increases in health costs were lower than expected. In addition, there were fewer covered dependent children of retirees. As we include a cost for dependent children, the lower child count is reflected in liability reduction due to lower health costs.

-Demographic experience was favorable. Note demographic experience looks back to last valuation and compares the assumed change in liability from last valuation date to current valuation date to actual experience. This is different from the demographic assumption changes mentioned above which are forward looking and capture the change in liability due to changes in assumptions that affect future demographic patterns. Part of the large demographic experience gain is due to a number of retirees who opted out of health coverage, but kept dental coverage. This is known as a lapse in coverage. We do not assume retirees will drop coverage in the future (i.e. we assume current retirees will maintain their coverage for their lifetimes).

-One change that increased liability was lowering our discount rate from 6.15% to 5.85% per year.

As of June 30, 2020, the County’s position is as follows:

| Total OPEB Liability |

$865,362,000 |

| Fiduciary Net Position |

$341,429,000 |

| Net OPEB Liability |

$523,933,000 |

| Active |

9,115 |

| Retirees and Survivors |

7,039 |

| Total Counts |

16,154 |

| Discount Rate |

5.85% |

Summary

Since 2006, the County has reduced its net OPEB liability by 80%. The County’s annual trust deposit of $20 million combined with the annual pay-go cost funded by the County ($57.1 million for FY 2019-2020) shows great progress, and meets the Actuarially Determined Contribution for pre-funding ($67.9 million). However, a 39.5% funded level does not yet meet the targeted level of 44%. The Board of Supervisors, through the County Administrator's Office will continue to work towards a financial balance between the provision of necessary services to the public and provision of competitive health care benefits for employees and retirees. These efforts will not only help to ensure the County’s overall fiscal stability and ability to deliver services, but will also increase the likelihood that health care benefits will be available to our employees and retirees in the future.

None of these reductions could have been achieved without the support and cooperation of our employees. Continued negotiations toward Countywide health care cost containment strategies and the redirection of designated future resources remain key to reducing the OPEB liability. The Board of Supervisors continues to make significant progress toward a solution for one of the biggest fiscal challenges the County has faced to date.

The results contained in this report are our best estimate; however, variation from these or any other estimates of future retiree medical costs is possible. Actual future costs may vary from the estimates in this report. Detailed information on the Board’s actions, including all of the County’s OPEB reports, is available on the County’s web-site at www.cccounty.us/1318/Other-Post-Employment-Benefits.

The County will be out of compliance with Governmental Accounting Standards Board Statements 74 and 75.