In 2004, due to growing concern over the potential magnitude of government employer obligations for post-employment benefits, the Governmental Accounting Standards Board enacted Statement 45 (GASB 45). The main reason for the Statement was to establish uniform accrual accounting and reporting of these governmental liabilities much like under the Financial Accounting Standards Board (FASB) rules that already applied to the private sector for OPEBs (and GASB 25 and 27 statements that already applied to governmental pension liabilities). Accrual accounting was needed to report the cost of providing government services over the working lifetime of employees providing the services rather than just the "pay-as-you-go" (paygo) cost that was not realized until after those employees retired.

Additionally, an intended audience of these GASB 45 results was the bond markets to allow better assessment of levels of government solvency in issuing debt. Although plan solvency was not the main impetus behind Statement 45, GASB 45 is considered 'funding friendly' because it adds some stability for those receiving the benefits, if those benefits are actually pre-funded. Because Statement 45 requires the public sector to account for total long term OPEB costs over the active service life of benefit-earning employees, rather than reporting current year OPEB costs only for existing retirees, it is thought that addressing these long-term liabilities would help to avoid the collapses in benefit plans that have occurred in the private sector.

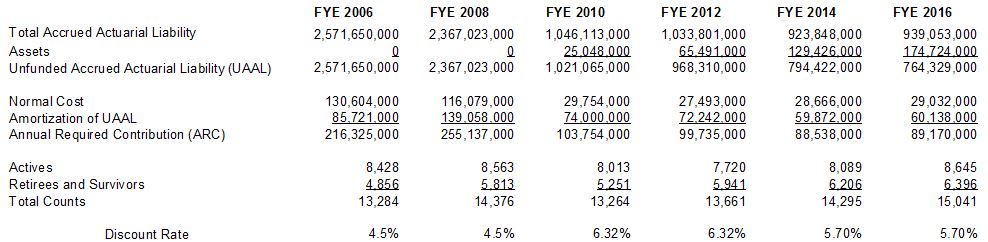

Pursuant to GASB 45 requirements, Contra Costa County ordered its initial actuarial report in 2006. The 2006 report valued the County’s unfunded liability for retiree medical costs at $2.6 billion based upon a cash discount rate. This outstanding liability, if fully amortized over the following 30 years, would have necessitated an Annual Required Contribution (ARC) of $216 million. At that point in time, $216 million would have been six times the amount that the County was paying toward retiree health care costs on a paygo basis.

As is described in the attached 2016 report and in the table below, the County has taken significant actions to address GASB 45 and to reduce its OPEB liability since the initial report of 2006. Interim valuation results have been presented to the Board of Supervisors, pursuant to California Government Code 7507, since the 2008 report. However, for comparison purposes, the table below compares bi-annual GASB 45 valuation results at fiscal year-end (FYE).

In June, 2007, the County established a funding target of 100% of the potential liability for the retiree population. At that time, retirees accounted for approximately 40% of the liability population. That figure is now 43% and expected to continue to grow. Partial pre-funding began in 2008 with an annual County allocation of $20 million. The County's OPEB was 3.9% funded in 2010, 6.3% in 2012, 14% in 2014, and as of January 1, 2016, the County's OPEB was 18.6% funded. Although the County has made great strides towards reducing the liability, the current funded ratio is only 18.6%. Additionally, the UAAL as a percentage of covered payroll, is still high at 109.8%. Pursuant to County Ordinance No. 2014-04, the annual resources of $20 million will be increased by $47 million to $67 million in FY 2022/23 when the County retires its current Pension Obligation Bond.

Both the 2006 and 2008 valuation reports used a 4.5% discount rate, reflecting the County’s funding policy at that time. The 2010 and 2012 results reflected a 6.32% discount rate to reflect the County’s adopted discount rate assumption based on $20 million in partial pre-pay into an OPEB trust fund, plus paygo funding. The 2014 and 2016 reports reflects a 5.70% discount rate, which reflects the County's current policies. This rate is derived based upon the fund's investment policy, level of partial funding, and long-term inflation assumption. Based upon the portfolio's target allocation, the average return of Trust assets over the next 30 years is expected to be 6.25%. Because the County's annual contribution is not equal to the Annual Required Contribution, GASB requires that the rate be blended with the expected return of the County's general fund (we assumed a long term return of 3.5%).

Throughout the last eight years through labor negotiations, the County has worked with employees to adopt and implement the County’s OPEB goals. Through the efforts of the majority of our employees, the County has adopted an OPEB financing plan that balanced the County's requirement to provide public services with its desire to provide competitive health care benefits to employees and fully complies with GASB 45. It is important to note that the significant improvement in the County’s OPEB liability could not have been achieved without the support of our employees. These efforts will not only help to ensure the County’s overall fiscal stability and ability to deliver services, but will also increase the likelihood that health care benefits will be available to our employees and retirees in the future.

A reconciliation of the County's valuation changes breaks out in the following way:

2006 to 2008

-

Updated Contra Costa County Employees' Retirement Association (CCCERA) pension valuation assumptions where applicable (valuation assumption)

-

Better overall medical and dental plan trend and renewals over the two years than originally assumed (demographic gain)

-

Fewer new retirements than originally assumed, which delayed the onset of benefits (demographic gain)

-

Overall cleaner and more complete data than was available in 2006

-

Effective 2008, the County contribution for non-represented retirees was set at the 2009 level for future years (this date was later changed to 2011 and included in subsequent valuation plan provisions)

2008 to 2010

-

Reduced liability due to the negotiated plan change savings over time. The impact from these changes was more than expected due to conservative plan change assumptions and up to date bargaining unit coding.

-

Migration to lower cost plans as a result of the plan changes and a resulting lower subsidy amount (active rates subsidizing retiree rates).

-

Demographic gains:

-

This was due to both active and retiree counts being lower than in the 2008 valuation,

-

Fewer new retirements than expected,

-

Fewer continuing retirees than expected, and

-

Fewer active employees than in 2008.

2010 to 2012

-

Reduced liability due to the negotiated plan change savings over time.

-

Migration to lower cost plans as a result of the plan changes and a resulting lower subsidy amount.

-

Demographic losses:

-

This was due to active counts being lower and retiree counts being higher than in the 2010 valuation,

-

More new retirements than expected (loss),

-

More retirees than in 2010 (loss), and

-

Fewer active employees than in 2010 (gain).

2012 to 2014

-

Reduced liability due to the negotiated plan change savings over time. See Appendix A of attached report (Summary of Benefits), for details regarding plan changes made for the majority of County employees.

-

Migration to lower cost plans as a result of the plan changes and a resulting lower subsidy amount.

-

Demographic losses:

-

Active and retiree counts were higher than in the 2012 valuation, however the ratio of actives to retirees remained at 43.4%,

-

More new retirements than expected (loss),

-

More retirees than in 2012 (loss), and

-

More active employees than in 2012 (loss).

2014 to 2016

-

Increased liability due to certain negotiated plan changes. See Appendix A of attached report (Summary of Benefits), for details regarding plan changes made for the majority of County employees.

-

Migration to lower cost plans as a result of the plan changes and a resulting lower subsidy amount.

-

Demographic loss was very small at approximately $3 million:

-

Active and retiree counts were higher than in the 2014 valuation, however the ratio of actives to retirees remained at 43%, and

-

More active employees than in 2014 (loss).

Summary

Over the last ten years, the County has reduced its OPEB UAAL by 63%, Normal Cost by 78%, amortization of UAAL by 29%, and Annual Required Contribution by 59%. Although the County’s annual trust deposit of $20 million combined with the annual paygo cost of $46 million shows great progress, it does not meet the GASB definition of paying the total Annual Required Contribution for pre-funding ($89.2 million). Additionally, a 18.6% funded level is still far from the targeted level of 43%. The Board of Supervisors, through the County Administrator's Office will continue to work towards a financial balance between the provision of necessary services to the public and provision of competitive health care benefits for employees and retirees.

None of these reductions could have been achieved without the support and cooperation of our employees. Continued negotiations toward Countywide health care cost containment strategies and the redirection of designated future resources remain key to reducing the OPEB liability. The Board of Supervisors continues to make significant progress toward a solution for one of the biggest fiscal challenges the County has faced to date.

The results contained in this report are our best estimate; however, variation from these or any other estimates of future retiree medical costs is possible. Actual future costs may vary from the estimates in this report. Detailed information on the Board’s actions, including all of the County’s OPEB reports, is available on the County’s web-site at www.cccounty.us/1318/Other-Post-Employment-Benefits.

The County will be out of compliance with GASB 45.