Summary of Major Fiscal Effects by state Legislative Analyst and state Director of Finance:

"Increased annual state tax revenue ranging from $3 billion to $4.5 billion, with the additional revenue used to support zero-emission vehicle programs and wildfire-related activities. Potential increased state administrative costs paid from other funding sources that could reach tens of millions to the low hundreds of millions of dollars annually. Net decrease in state and local transportation revenue of up to several tens of millions of dollars annually in the initial years, and growing to up to a few hundreds of millions of dollars annually after several years."

Proposition 30. Provides Funding for Programs to Reduce Greenhouse Gas Emissions by Increasing Tax on Personal Income Over $2 Million. Initiative Statute.

From the Legislative Analyst's Office:

BACKGROUND

California Personal Income Taxes. The state collects a tax on personal income earned within the state. Last year, the personal income tax raised over $130 billion in revenue. Most of the revenue helps pay for education, prisons, health care, and other public services.

Zero-Emission Vehicle Programs. The state has goals to limit greenhouse gas emissions that contribute to climate change, such as carbon dioxide from burning fossil fuels. To help meet these goals, the state has programs that promote zero-emission vehicles (ZEVs)—or vehicles that do not release pollution from the tailpipe. Examples of ZEVs include electric cars and hydrogen fuel cell cars. The state requires ride-sharing companies (such as Uber and Lyft) to use an increasing number of ZEVs for their services. The state also gives some funding to help households, businesses, and governmental agencies buy new ZEVs and install fueling infrastructure, such as charging stations for electric cars.

Wildfire Response and Prevention Programs. The state has the main responsibility for wildfire response activities—commonly known as firefighting—on about one-third of California’s land area. (The federal government and local agencies have the main responsibility for wildfire response everywhere else in California.) Wildfire response activities help limit the spread of large wildfires and stop them from damaging communities and harming residents. The state also runs wildfire prevention programs to reduce the chances that wildfires will start and to limit the damage they cause when they do occur. Some examples of wildfire prevention activities include removing trees from overgrown forests and clearing dead plants that are likely to catch on fire in areas near buildings.

PROPOSAL

Creates a New Tax on High-Income Taxpayers

Beginning January 2023, Proposition 30 requires taxpayers with incomes above $2 million each year (annually) to pay an additional tax of 1.75 percent on the share of their income above $2 million. This additional tax would end by January 2043. The tax could end several years earlier if California is able to drop its statewide greenhouse gas emissions below certain levels before then.

Uses Revenue to Expand ZEV Programs and Wildfire Activities

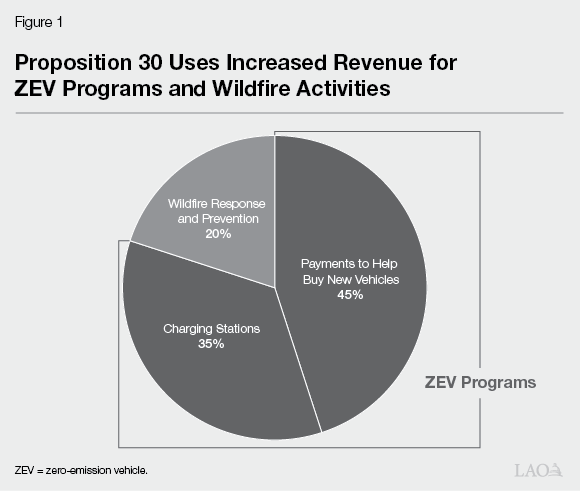

Proposition 30 requires that the revenue from the new tax go to increasing funding for ZEV programs and wildfire activities, as shown in Figure 1. The money would go to several state agencies to manage the programs and activities.

ZEV Programs (80 Percent). About 80 percent of the total revenue is for two ZEV program categories:

-

Payments to Help Buy New Vehicles. Most of this money must be used to help households, businesses, and governments pay for part of the cost of new passenger ZEVs (such as cars, vans, and pick-up trucks). The rest of the money would be available for other programs. These include payments to businesses and governments to help buy large ZEVs (such as trucks and buses) and programs that encourage less driving and improve local air quality.

-

Charging Stations. This money would be used to install and operate ZEV charging and fueling stations at places such as apartment buildings, single-family homes, and public locations.

For each category above, at least half of the money must be spent on projects that benefit people who live in or near heavily polluted and/or low-income communities. The rest of the money could be spent on projects anywhere in the state.

Wildfire Response and Prevention Activities (20 Percent). About 20 percent of total revenue must be spent on wildfire response and prevention activities. In general, the state would have to prioritize spending to hire, train, and retain state firefighters. The rest of the money could be used for other wildfire response and prevention activities.

=====================================================

Support and Opposition

According to Ballotpedia: "Yes on 30: Clean Air California" is leading the campaign in support of Proposition 30. It has received endorsements from the California State Association of Electrical Workers and California Environmental Voters. Two other committees also registered in support of Proposition 30: "Yes on 30: Working Families and Environmental Voters to Expose Greedy Billionaires and CEOs" and "California Environmental Voters Issues Committee." Together the committees reported over $37.1 million in contributions. Lyft was the top contributor with $15 million in contributions. Bill Magavern, one of the authors of the initiative, said, "We need to protect the health of Californians. California needs to step up to protect its own. The state is doing a lot to reduce harmful emissions but the budget, even with the governor making the commitment he has, is insufficient to address these problems."

The measure is also endorsed by the following organizations:

Bay Area Air Quality Management District

American Lung Association

California Democratic Party

State Building and Construction Trades Council

Association of Bay Area Governments

Metropolitan Transportation Commission

There is one committee registered in opposition to Proposition 30: No on 30. The committee reported $11.5 million in contributions. Proposition 30 has received opposition from Gov. Newsom, the California Teachers Association, and the Howard Jarvis Taxpayers Association. Gov. Newsom said, "Prop. 30 is a special interest carve-out — a cynical scheme devised by a single corporation to funnel state income tax revenue to their company. … Californians should know that just this year our state committed $10 billion for electric vehicles and their infrastructure."

For more information about the measure, see Attachment A: Bay Area Air Quality Management District Board meeting information.

Speakers: Gretchen Newsom, International Brotherhood of Electrical Workers (IBEW); Augustina Olman; No name given; William Muetzenberg, ; Sandra Lowe, City of Sonoma; Oscar Garcia, California EnviroVoters; Caller 6770.