Discussion At the November 15, 2016 Board of Supervisors meeting the prior version of the subject bill was discussed, Assembly Bill X 1-26 (Frazier), along with the identical Senate Bill X1-1 (Beall). While there was a substantial amount of discussion, no action was taken.

In the past two years there has been a substantial amount of dialog regarding the need for additional road maintenance funding at the Transportation, Water, and Infrastructure Committee (

TWIC), the Board of Supervisors (BOS), and the Contra Costa Transportation Authority (CCTA). The dialog has been primarily generated by: 1) preparations to bring Measure X to the November 2016 ballot, 2) efforts at the state to generate additional revenue for transportation, and more directly 3) the well-documented increasing need for additional transportation infrastructure maintenance funding which is discussed in more detail immediately below.

Need for Transportation Funding Increase: Summary: There is a need for an increase in transportation maintenance funding because revenues have effectively been decreasing due to numerous economic factors:

- Construction Cost Index increases diminish the buying power of revenues.

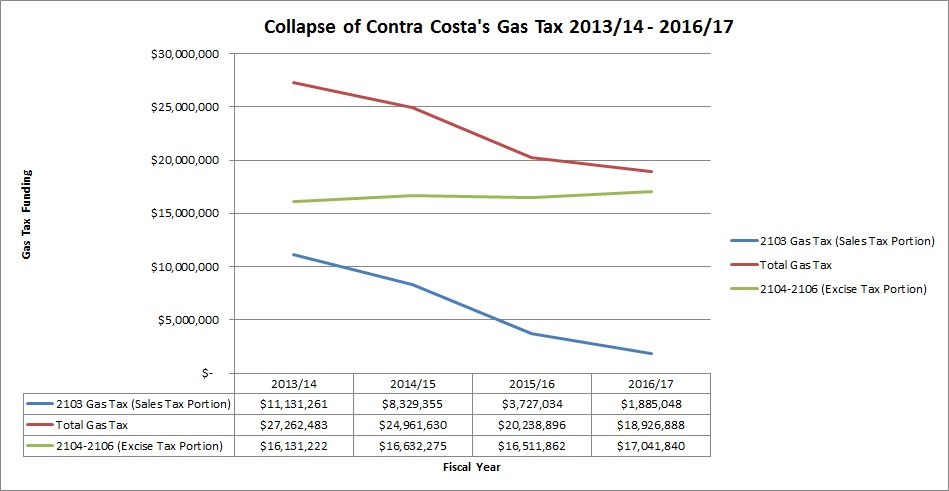

- The increase in the number of fuel efficient vehicles and electric vehicles reduces gas tax revenues. See "Collapse of Contra Costa's Gas Tax" graphic below.

- Requirements for roadway project designs are continually getting more stringent and expensive, primarily due to required storm water management systems.

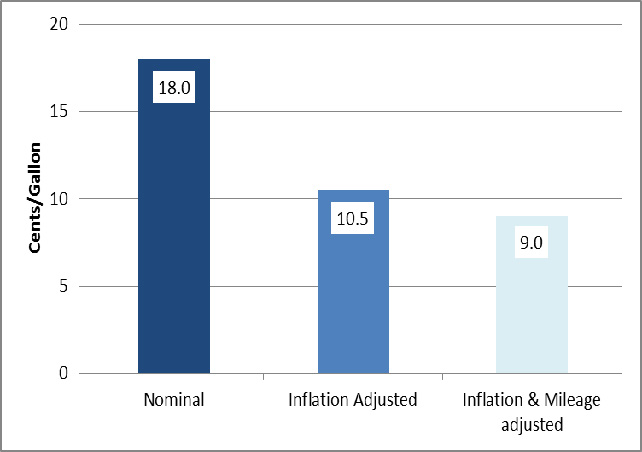

- Inflationary erosion of the unit based gas tax. See "Value of 18-cent Gas Tax in 2014" graphic below.

Value of 18-cent Gas Tax in 2014 (1)

California Statewide Local Streets and Roads Needs Assessment (Source: Caltrans, Division of Budgets)

(1) Inflation adjusted value using 1994 prices. 1994 was the last time the excise tax was raised.

Prior Analysis/Reports Establishing the Need for Additional Maintenance Funding

The report that went to the BOS on November 15, 2016 had a substantial amount of additional information related to the need for increased transportation funding. Information included:

- Documentation regarding the scale of the need in Contra Costa County which was developed by the Metropolitan Transportation Commission and the Public Works Department (24 year analysis identified a $442 million shortfall in pavement and directly related non-pavement needs),

- Details regarding the short term gas tax reduction and the magnifying effect of the gas tax swap "true up",

- References to the staff report prepared regarding Measure X and the level of maintenance funding needed, and

- Several fact sheets with data points and information regarding the transportation funding situation.

Update: Impact on County Operations: Building on information discussed at the November 15, 2016 BOS meeting, staff has prepared additional information regarding the impact on County operations of the reduction of gas tax revenue to the state and local jurisdictions. The Public Works Department is proposing a project delay strategy that postpones the construction of projects for one to two years in order to help close a $7.9 million budget gap. In the event that the State Legislature fails to enact a transportation funding fix the delays will be much greater and may result in the loss of already secured grant funding. The following projects will be impacted:

1. Byron Highway & Camino Diablo Intersection Improvements (this includes federal funding that could potentially be lost and if we don’t deliver could prevent us from applying for future federal safety grants)

2. Marsh Creek Road Bridge Replacement (Bridge No 28C141)

3. Morgan Territory Road Bridge Scour Repairs

4. Marsh Creek Road Bridge Replacement (Bridge 28C143 & 28C145)

5. Vasco Road Safety – Phase 2 ($50,000 seed money if other money became available)

6. Tara Hills Pedestrian Infrastructure Project

7. Main Street, Byron Sidewalk Improvements

8. Pomona Street Pedestrian Safety Improvements Project – Phase II

9. Pedestrian Crossing Enhancements – Central & East County

10. Maintenance Surface Treatment Program (see discussion below)

11. Blackhawk Road Bikeway Project

In addition to specific project delays, closing the budget gap may include a reduction or possible cancellation of the surface treatment program for the upcoming fiscal year. Future years, if the transportation funding situation is not resolved, may require more drastic cuts.

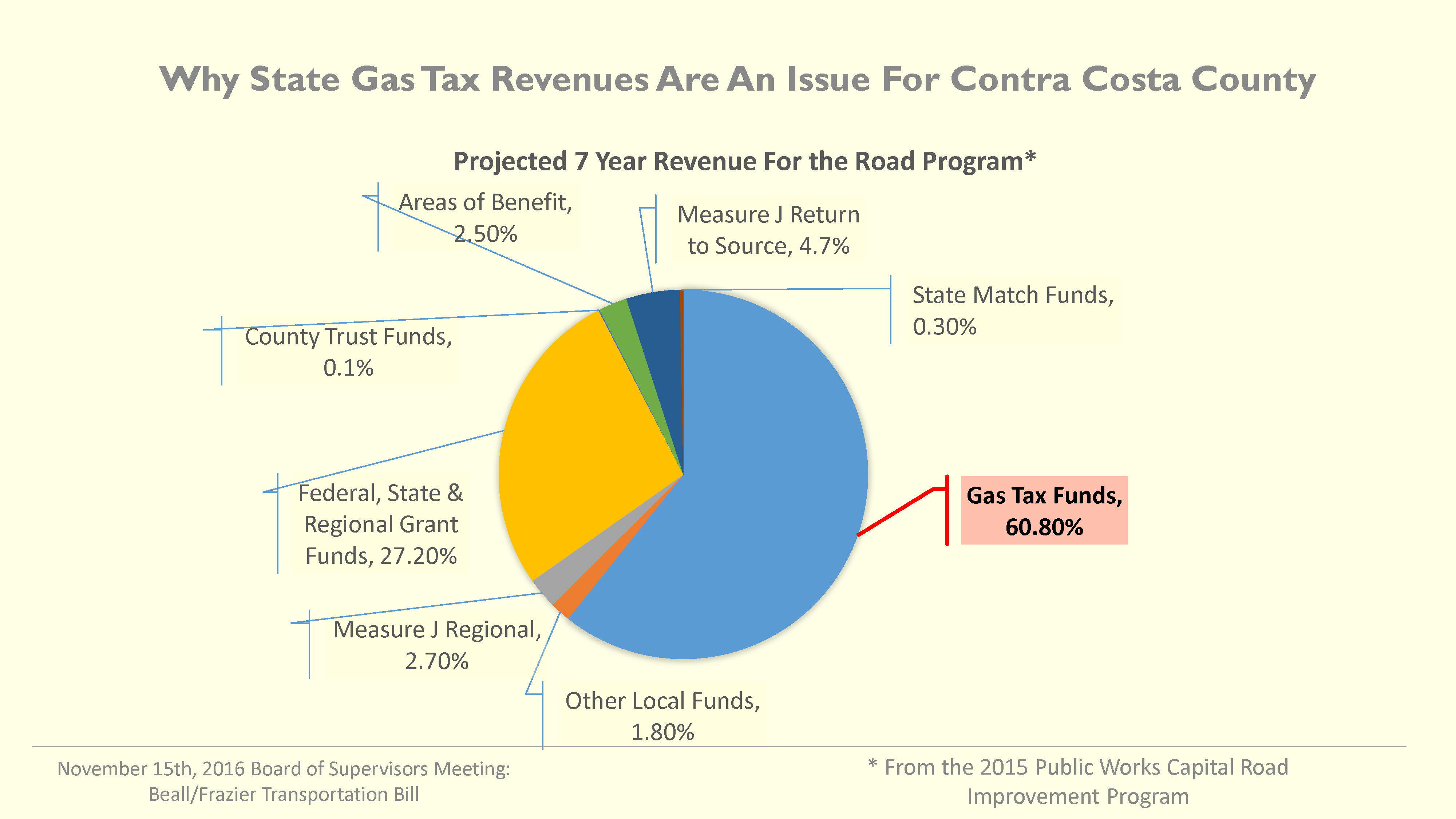

State Gas Tax Distribution

At the November 15, 2016 BOS meeting a presentation was given that displayed how gas taxes are distributed in California. The presentation is attached in its entirety (StateGasTaxPresentation.pdf). The final slide is included below as it communicates why the state gas taxes are critical to Contra Costa County. As depicted below, state gas taxes represent the largest share of revenue in the Road Program. However, the second largest portion of revenue for the Road Program is "Federal, State & Regional Grant Funds" which depends on Gas Tax Funds for matching revenue. This situation magnifies the impact of the loss of state gas taxes. In addition, state gas taxes are more critical to Contra Costa relative to other jurisdictions in that we don't rely on general fund sources for road maintenance.

Update: Legislation: Below is a summary of the subject bill developed by Mark Watts, the County's legislative advocate. Where they exist, differences from the previous, 2016 version of 2016 bill (AB X 1-26) and the current, 2017 version of the bill (AB 1) are noted:

AB 1 (Frazier) Transportation Funding Package

- A $6.0 billion (was $7.4 in 2016's AB X 1-26)) annual funding package to repair and maintain our state and local roads, improve our trade corridors, and support public transit and active transportation.

- A $706 million repayment of outstanding transportation loans for state and local roads.

- Eliminates the BOE “true up” that causes funding uncertainty and is responsible for drastic cuts to regional transportation projects.

- Indexes transportation taxes and fees to the California CPI in order to keep pace with inflation.

- Includes reforms and accountability for state and local governments to protect taxpayers.

- Streamlines transportation project delivery to help complete projects quicker and cheaper.

- Protects transportation revenue from being diverted for non-transportation purposes.*

- Helps local governments raise revenue at home to meet the needs of their communities.*

New Annual Funding

- State -- $1.9 (Was $2.9 in 2016's AB X 1-26) billion annually for maintenance and rehabilitation of the state highway system.

- Locals -- $2.4 (Was $2.5 billion in 2016's AB X 1-26) annually for maintenance and rehabilitation of local streets and roads.

- Regions -- $577 (Was $534 million in 2016's AB X 1-26) annually to help restore the cuts to the State Transportation Improvement Program (STIP).

- Transit -- $563 (Was $516 in 2016's AB X 1-26) million annually for transit capital projects and operations.

- Freight -- $600 (Was $900 in 2016's AB X 1-26) million annually for goods movement.

- Active Transportation -- $80 million annually, with up to $150 million possible through Caltrans efficiencies, for bicycle and pedestrian projects.

- Constitutional Amendment to help locals raise funding at home by lowering the voter threshold for transportation tax measures to 55 percent.*

Reforms and Accountability

- Restores the independence of the California Transportation Commission (CTC).

- Creates the Office of Transportation Inspector General to oversee all state spending on transportation programs.

- Increases CTC oversight and approval of the State Highway Operations and Protection (SHOPP) program.

- Requires local governments to report streets and roads projects to the CTC and continue their own funding commitments to the local system.

Streamlining Project Delivery

- Permanently extends existing CEQA exemption for improvements in the existing roadway.

- Permanently extends existing federal NEPA delegation for Caltrans.

- Creates an Advance Mitigation program for transportation projects to help plan ahead for needed environmental mitigation.

New Annual Funding Sources

- Gasoline Excise Tax -- $1.8 billion (12 cents per gallon increase). This is a decrease from 2016's AB X 1-26 which was $2.5 billion (17 cents per gallon increase).

- End the BOE "true up" -- $1.1 billion

- Diesel Excise Tax -- $600 million (20 cents per gallon increase). This is a decrease from 2016's AB X 1-26 which was $900 million (30 cents per gallon increase)

- Vehicle Registration Fee -- $1.3 billion ($38 per year increase). This is identical to 2016's AB X 1-26

- Zero Emission Vehicle Registration Fee (1) -- $21 million ($165 per year starting in 2nd year) (Was $16 million ($165 per year starting in 2nd year) in 2016's AB X 1-26)

- Truck Weight Fees -- $500 million (return to transportation over five years). This is a decrease from 2016's AB X 1-26 which was $1 billion.

- Diesel Sales Tax -- $263 million (increase increment to 5.25%). This is an increase from 2016's AB X 1-26 which was $216 million (3.5% increase).

- Cap and Trade -- $300 million (from unallocated C&T funds)

- Miscellaneous transportation revenues (2) -- $185 million (Was $149 million in 2016's AB X 1-26)

Keeping Promises and Protecting Revenues

- One-time repayment of outstanding loans from transportation programs over two years. ($706 million)

- Return of truck weight fees to transportation projects over five years. ($500 million, was $1 billion in 2016's AB X 1-26)

- Constitutional amendment to ensure new funding cannot be diverted for non-transportation uses.*

(1) Zero Emission Vehicle Registration Fees, the revenue increases but the per year/vehicle fee does not. An updated forecast was provided which resulted in the revenue increase.

(2) Miscellaneous transportation revenues are a combination of funds that [1] accrue to Caltrans from property rentals and the minor sources, and [2] a correction to a misinterpretation by State Controller regarding funds that ought to accrue to the Highway Users Tax Account (HUTA) (fuel tax funds for local roads) when the Tax Swap was enacted. Regarding [2], the misinterpretation has continued to the benefit of the state General Fund, when in fact the subject revenues should be transferred to the HUTA.

* These provisions will be addressed in companion bills. During the November 15, 2016 Board of Supervisors discussion regarding SB X 1-1 and AB X 1-26, additional information on these companion bills was requested but not available. As of early January 2017 we have a commitment from the Bills author to pursue these initiatives but have no detail. The County's 2016 State Legislative platform includes support for a threshold reduction for transportation taxes:

General Revenues/Finances: 44. SUPPORT a reduction in the 2/3rd vote requirement to 55% voter approval for locally-approved special taxes that fund health, education, economic, stormwater services, library, transportation and/or public safety programs and services.

Late Breaking Information

Governors Office: At the November 15, 2016 BOS meeting, questions were raised about the Governor's position on the bills. At that time, staff did not have any information other than conversations were taking place between the Governors office and the authors of Assembly Bill X 1-26 (Frazier) along with the identical Senate Bill X1-1 (Beall). As this report was being submitted, the Governor released his proposed budget which includes a number of transportation funding reforms and revenue increases. Sufficient time was not available to analyze the proposal for this report. As additional information becomes available staff will bring it to the Transportation, Water, and Infrastructure Committee and the BOS.

Future Legislation Related to Transportation Revenue Protection and Voter Threshold Reduction: As this report was being submitted staff became aware that language has been submitted to the State Legislative Counsel's office for legislation related to protecting transportation revenue for use solely in streets and highways purposes and a reduction in the vote threshold required for the passage of transportation tax measures. Sufficient time was not available develop information for this report. As additional details become available, staff will bring it to the Transportation, Water, and Infrastructure Committee and the BOS.

Input from Other Agencies/Organizations

Attached: Metropolitan Transportation Commission: Legislation Committee Staff Report: SUPPORT: Transportation Funding: AB 1 (Frazier)/SB 1 (Beall)

Attached: California State Association of Counties: Bill Analysis: AB 1 (Frazier)/SB 1 (Beall): Transportation Funding/Reform

Registered Opposition

None on File

Registered Support

Apex Group

Associated General Contractors of California

Bay Area Council

California Alliance for Jobs

California Association of Councils of Government

California Business Roundtable

California Construction & Industrial Materials Association

California State Association of Counties

California State Association of Counties

California State Council of Laborers

California Transit Association

California Transportation Commission

Caterpillar Inc.

City of Ontario

City of Rio Vista

DeSilva Gates Construction

Granite Construction

Griffith Company

International Union of Operating Engineers – CA/NV

League of California Cities

League of California Cities

Los Angeles Chamber of Commerce

Marin County Board of Supervisors

Northern California Carpenters Regional Council

Orange County Business Council

Politico Group

Santa Clara County Board of Supervisors

Silicon Valley Leadership Group

Skanska

Smith Watts & Hartmann

Solano Transportation Authority

Southern California Contractors Association

Southern California Leadership Council

Southern California Partnership for Jobs

State Building & Construction Trades Council of California

Teichert Construction

Transportation Agency for Monterey County

Transportation California

United Contractors

United Contractors

Vulcan Materials Company

Contra Costa County would not have a position on the bill.

Speaker: Debbie Toth, Choice in Aging.